-

Articles/Ads

Article HOUSE OF COMMONS. ← Page 5 of 12 →

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

House Of Commons.

reign service , instead of two-pence half-penny , as -was formerly the case ; and this might be done without injury to the soldier . A reduction not y ^ t ascertained would also take place in several foreign corps . In the estimates , the guards and garrisons were rated at 4 8 , 609 men ; and the troops in the plantations 30 , 018 , making of regular troops 78 , 627 , not including the Irish establishment , or troop * in the East Indies . The militia and fencible cavalry were 52 , 291 , the fencible cavalry 6 , 940 men . " ^ THE BANK

. Wednesday , 22 . The Order of the Day being read for a Committee of the whole House on the Bank restriction bill , Mr . Hobhouse said that he had opposed a similar Bill last year , considering it to be rendered necessary only by the rapacity of Ministers . He saw no reason to alter his opinion on the present occasion ; nor did he see the difference between this and other wars , alledged by Ministers as , a reason for reviving the Bill . As to the flourishing situation of the Bank , it appears that the increase of their surplus , since February 29 , was on y j 2 , 6 ool . Mr . Pitt defended the Bill . Considering the avowed object ofthe and

enemy , that their efforts were directed against public credit , the Committee were justified in theiropinion , that the restriction ought to be continued . Messrs . Allardice and Nicholls contended that the Bank ought to be independent of Government . Mr . Tierney objected to the principle of the Bill . Major Elford and Mr . W . Bird highly approved of it . It went then through the Committee , and the blank in the restricting clause was filled up with the words , ' until the conclusion of the war by a definitive treaty of peace . '

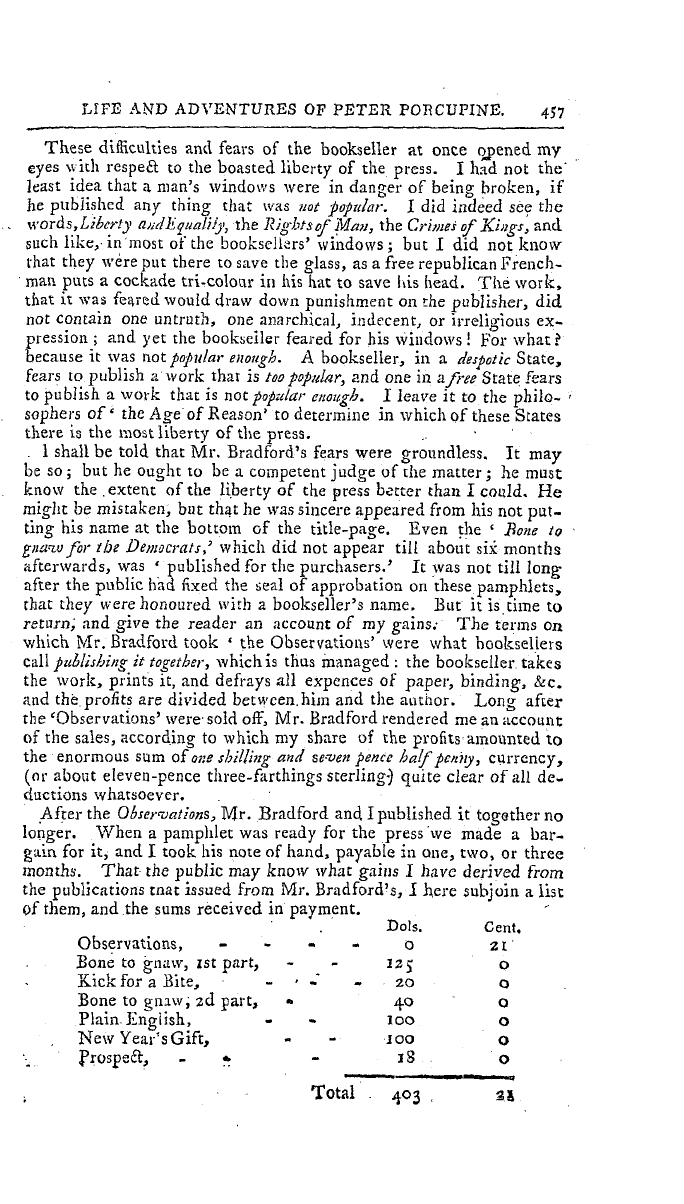

THE BUDGET . Friday , 24 The House having resolved itself into a Committee of Ways and Means , Mr . Pitt , after prefacing , as usual , that every thing dear to us was involved in the present contest , that our existence as a nation was at a stake , and that it behoved us to meet the occasion with adequate means , entered into a statement . of our income and expenditure . The following are the principal heads of expence . Navy - 12 , 539 , 000 / Reduction of Debt - 200 , 000 Army - . - - 10 , 112 , 000 Deficiency of Grants - 680 , 000

Ordnance - - 1 , 291 , 000 —— Miscellaneous Services - 674 , 000 Total 25 , 49 6 , 000 Considering this estimate as correct , Mr . Pitt observed that it fell short of that of last year by no less than 6 , 700 , 0001 . owing principally to reductions in the army . He then proceeded to the Ways and Means , which he proposed should be as follows : Growing Produce ofthe Con- New Loan - - 12 , 000 , 000 ' solidated Fund - 750000 ! Increase of Assessed Taxes 7 000 000

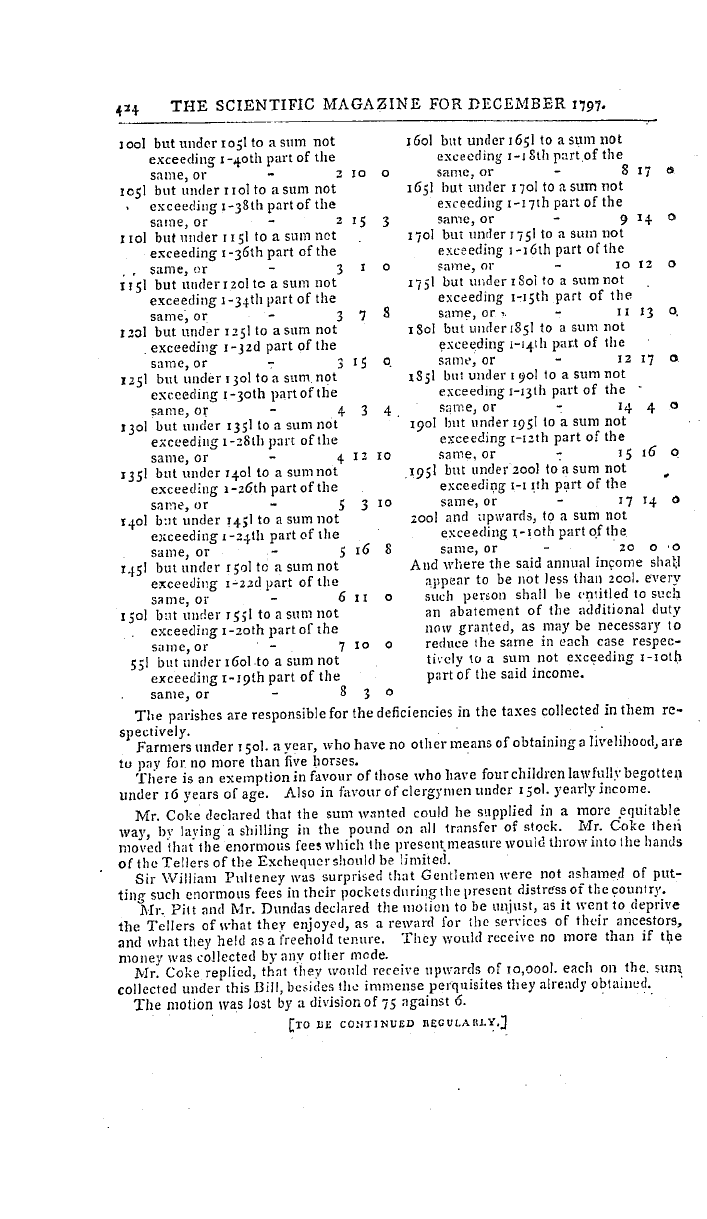

, , , Land and Malt - - 2 , 750 , 000 . Exchequer Bills - 3 , 000 , 000 ' . Total 25 , 500 , 000 ' He next explained the mode in which he meant to increase the assessed taxes . Those not previously subject to them would be altogether excluded . This class consisted of 5 or 600 , 000 . house-keepers , chiefly of inferior artizans and labourers , making with their families a population of three millions . The class of persons upon whom this tax bore were 7 or 800 . 000 house-keepers , amounting with their families to about four millions of souls , and the assessed taxes paid bv them to 2700

,, 0001 ; but the imposts in question did not bear with an equal pressure upon all . Four hundred thousand housekeepers of the latter description paid no more than 140 , 000 k nor did he mean that the increase should fall upon these as heavily as upon the more opulent . There were two species of assessed taxes . The first , laid upon houses , was divided into three parts , the window tax , the tax laid on in 1780 and the commutation tax . The others were of a different description , and their payment optional , such as the duties on servants , carriages , horses , & c . On the persons paying only the house tax , the duty on an average would only be doubled . Those who the dutieson

paid horses , carriages , & c . would pay a triple rate ; and in some instances it was intended to make it even three and a half , or four times the present amount . A general triple rate would have produced upwards of eight millions , but by the modification it would be reduced to seven , It was supposed

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

House Of Commons.

reign service , instead of two-pence half-penny , as -was formerly the case ; and this might be done without injury to the soldier . A reduction not y ^ t ascertained would also take place in several foreign corps . In the estimates , the guards and garrisons were rated at 4 8 , 609 men ; and the troops in the plantations 30 , 018 , making of regular troops 78 , 627 , not including the Irish establishment , or troop * in the East Indies . The militia and fencible cavalry were 52 , 291 , the fencible cavalry 6 , 940 men . " ^ THE BANK

. Wednesday , 22 . The Order of the Day being read for a Committee of the whole House on the Bank restriction bill , Mr . Hobhouse said that he had opposed a similar Bill last year , considering it to be rendered necessary only by the rapacity of Ministers . He saw no reason to alter his opinion on the present occasion ; nor did he see the difference between this and other wars , alledged by Ministers as , a reason for reviving the Bill . As to the flourishing situation of the Bank , it appears that the increase of their surplus , since February 29 , was on y j 2 , 6 ool . Mr . Pitt defended the Bill . Considering the avowed object ofthe and

enemy , that their efforts were directed against public credit , the Committee were justified in theiropinion , that the restriction ought to be continued . Messrs . Allardice and Nicholls contended that the Bank ought to be independent of Government . Mr . Tierney objected to the principle of the Bill . Major Elford and Mr . W . Bird highly approved of it . It went then through the Committee , and the blank in the restricting clause was filled up with the words , ' until the conclusion of the war by a definitive treaty of peace . '

THE BUDGET . Friday , 24 The House having resolved itself into a Committee of Ways and Means , Mr . Pitt , after prefacing , as usual , that every thing dear to us was involved in the present contest , that our existence as a nation was at a stake , and that it behoved us to meet the occasion with adequate means , entered into a statement . of our income and expenditure . The following are the principal heads of expence . Navy - 12 , 539 , 000 / Reduction of Debt - 200 , 000 Army - . - - 10 , 112 , 000 Deficiency of Grants - 680 , 000

Ordnance - - 1 , 291 , 000 —— Miscellaneous Services - 674 , 000 Total 25 , 49 6 , 000 Considering this estimate as correct , Mr . Pitt observed that it fell short of that of last year by no less than 6 , 700 , 0001 . owing principally to reductions in the army . He then proceeded to the Ways and Means , which he proposed should be as follows : Growing Produce ofthe Con- New Loan - - 12 , 000 , 000 ' solidated Fund - 750000 ! Increase of Assessed Taxes 7 000 000

, , , Land and Malt - - 2 , 750 , 000 . Exchequer Bills - 3 , 000 , 000 ' . Total 25 , 500 , 000 ' He next explained the mode in which he meant to increase the assessed taxes . Those not previously subject to them would be altogether excluded . This class consisted of 5 or 600 , 000 . house-keepers , chiefly of inferior artizans and labourers , making with their families a population of three millions . The class of persons upon whom this tax bore were 7 or 800 . 000 house-keepers , amounting with their families to about four millions of souls , and the assessed taxes paid bv them to 2700

,, 0001 ; but the imposts in question did not bear with an equal pressure upon all . Four hundred thousand housekeepers of the latter description paid no more than 140 , 000 k nor did he mean that the increase should fall upon these as heavily as upon the more opulent . There were two species of assessed taxes . The first , laid upon houses , was divided into three parts , the window tax , the tax laid on in 1780 and the commutation tax . The others were of a different description , and their payment optional , such as the duties on servants , carriages , horses , & c . On the persons paying only the house tax , the duty on an average would only be doubled . Those who the dutieson

paid horses , carriages , & c . would pay a triple rate ; and in some instances it was intended to make it even three and a half , or four times the present amount . A general triple rate would have produced upwards of eight millions , but by the modification it would be reduced to seven , It was supposed