-

Articles/Ads

Article HOUSE OF COMMONS. ← Page 6 of 12 →

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

House Of Commons.

that the tax would absorb nearly one-tenth ofthe property ofthe individual taxed ; and who could , on the present occasion , refuse such a sacrifice ? The present , said Mr . Pitt , isanexertionyiw ( iiir « . rw /« i « , in which it is requisite that the hoard of the penurious should be as open as the purse of the prodigal ; and if it appears that persons possessing hoards of finance evaded the vigilance ofthe Minister of finance , all that could be done was to make as jii 3 t an assessment as could be ascertained . It was not to he suffered that persons should diminish their expence to evade the tax ; and therefore , the rate must not be grounded on a future estimate , but on that of the ht have himself his

past year . In cases where an individual mig entangled beyond means , it might be necessary to call on him for a declaration that the tax exceeded the tenth of his property . Mr . Husssy was of opinion that an equal tax on land would be more expedient than the imposition announced . Messrs . Nicholis , Curwen , and Tiernev , thought that Placemen and Pensioners ought to bear a great share ofthe public burthens . In the time of Oueen . Anne the salaries of office were limited to 500 I . a year , which , they contended , should take place in the present situalion ofthe country .

WAYS AND MEANS . Monday , Dec . 4 . The House having resolved itself into a Committee of Ways and Means , Mr . Pitt rose to give the further details of his plan relative to the assessed taxes . He said , that existing circumstances and the atrocity of our enemy called fortlie most vigorous exertions . ; and that upon reviewing the internal stateofthe country , he was more than ever convinced of its real wealth , radical strength , and true power . Of these we had more than enough to defeat the purpose of our javeleratefoc ; but as his most serious attacks were of late directed against the funding much in

system , his views could only be defeated by avoiding as as possible an - crease of debt , and by making a strong effort to raise a great part of our present expenditure within the year . As i : was impossible to make a direct call upon the wealth of each person , no better criterion of the income and expenditure of individuals could be found than the assessed taxes , which embraced so many articles both of choice and necessity . The number of poor who did not contribute to them was no less than three millions ; that of persons assessed amounted to 800 , 000 heads of familiesmaking a population of four millions . But even with respect

, to these , the tax would suffer various modifications . lie did not mean that when a person complains of being charged by the new tax beyond the tenth of his income that , in stating such income upon oath , he should include ihe amount ofthe assessed taxes paid heretofore . A . s to the commissioners to be appointed to rereive such declarations , and grant relief , they might be select vestries , where such

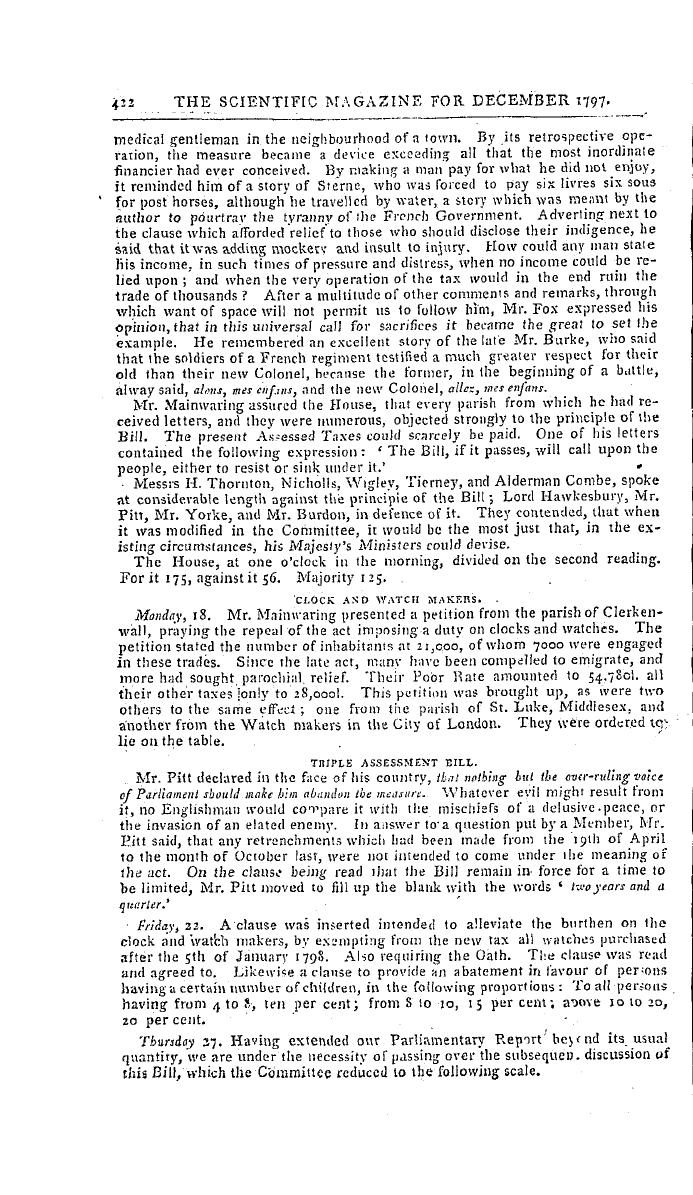

existed , or be taken by lot in the parish or district am ,. ng persons not having any claim to relief themselves . The former tax he had taken at about 2 , 700 , 000 ! , The new tax , if upon the whole equal to a triple rate , would amount to 8 , i 6 o , oool , The poundage upon the old tax was nearly ioo , ocol . On the new , at the same rate it would be 300 , 000 ! . ; but it was his intention to give the commissioners only one . It was impossible to say from mere conjecture what the deductions arising from the reduced rate of the lower classes , and from the relief to b * granted , would amount to but considering that the persons paying three and a half and four times

; their old taxes would afford a great compensation , he would venture to take the tax at 7 ooo , oool . especially as the cavalry act had been the means of discovering that the most scandalous evasions had been practised , lor many years , by persons , who if ' . heir rank and situation were known , would be marked by the public reprobation . After announcing some further modifications , and making several observations on the necessity of this great effort , Mr . Pitt concluded by moving several resolutions . of the le of the and ht that tha

Sir W . Pulteney approved princip measure , thoug whole supplies for the year might be raised in a similar manner , instead of recurring in part to the destructive system of funding . If he was consulted , he said , he could ,-ropose a plan that would abolish the funding system for ever . Mr . Nicholis objected to the tax as unjust , because it had a retrospective effect ' and because it was not fairly assessed . It would , he said , crush the middle orders of society directly , and the lower ones remotely . Of this , the coach-mak-

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

House Of Commons.

that the tax would absorb nearly one-tenth ofthe property ofthe individual taxed ; and who could , on the present occasion , refuse such a sacrifice ? The present , said Mr . Pitt , isanexertionyiw ( iiir « . rw /« i « , in which it is requisite that the hoard of the penurious should be as open as the purse of the prodigal ; and if it appears that persons possessing hoards of finance evaded the vigilance ofthe Minister of finance , all that could be done was to make as jii 3 t an assessment as could be ascertained . It was not to he suffered that persons should diminish their expence to evade the tax ; and therefore , the rate must not be grounded on a future estimate , but on that of the ht have himself his

past year . In cases where an individual mig entangled beyond means , it might be necessary to call on him for a declaration that the tax exceeded the tenth of his property . Mr . Husssy was of opinion that an equal tax on land would be more expedient than the imposition announced . Messrs . Nicholis , Curwen , and Tiernev , thought that Placemen and Pensioners ought to bear a great share ofthe public burthens . In the time of Oueen . Anne the salaries of office were limited to 500 I . a year , which , they contended , should take place in the present situalion ofthe country .

WAYS AND MEANS . Monday , Dec . 4 . The House having resolved itself into a Committee of Ways and Means , Mr . Pitt rose to give the further details of his plan relative to the assessed taxes . He said , that existing circumstances and the atrocity of our enemy called fortlie most vigorous exertions . ; and that upon reviewing the internal stateofthe country , he was more than ever convinced of its real wealth , radical strength , and true power . Of these we had more than enough to defeat the purpose of our javeleratefoc ; but as his most serious attacks were of late directed against the funding much in

system , his views could only be defeated by avoiding as as possible an - crease of debt , and by making a strong effort to raise a great part of our present expenditure within the year . As i : was impossible to make a direct call upon the wealth of each person , no better criterion of the income and expenditure of individuals could be found than the assessed taxes , which embraced so many articles both of choice and necessity . The number of poor who did not contribute to them was no less than three millions ; that of persons assessed amounted to 800 , 000 heads of familiesmaking a population of four millions . But even with respect

, to these , the tax would suffer various modifications . lie did not mean that when a person complains of being charged by the new tax beyond the tenth of his income that , in stating such income upon oath , he should include ihe amount ofthe assessed taxes paid heretofore . A . s to the commissioners to be appointed to rereive such declarations , and grant relief , they might be select vestries , where such

existed , or be taken by lot in the parish or district am ,. ng persons not having any claim to relief themselves . The former tax he had taken at about 2 , 700 , 000 ! , The new tax , if upon the whole equal to a triple rate , would amount to 8 , i 6 o , oool , The poundage upon the old tax was nearly ioo , ocol . On the new , at the same rate it would be 300 , 000 ! . ; but it was his intention to give the commissioners only one . It was impossible to say from mere conjecture what the deductions arising from the reduced rate of the lower classes , and from the relief to b * granted , would amount to but considering that the persons paying three and a half and four times

; their old taxes would afford a great compensation , he would venture to take the tax at 7 ooo , oool . especially as the cavalry act had been the means of discovering that the most scandalous evasions had been practised , lor many years , by persons , who if ' . heir rank and situation were known , would be marked by the public reprobation . After announcing some further modifications , and making several observations on the necessity of this great effort , Mr . Pitt concluded by moving several resolutions . of the le of the and ht that tha

Sir W . Pulteney approved princip measure , thoug whole supplies for the year might be raised in a similar manner , instead of recurring in part to the destructive system of funding . If he was consulted , he said , he could ,-ropose a plan that would abolish the funding system for ever . Mr . Nicholis objected to the tax as unjust , because it had a retrospective effect ' and because it was not fairly assessed . It would , he said , crush the middle orders of society directly , and the lower ones remotely . Of this , the coach-mak-