-

Articles/Ads

Article HOUSE OF COMMONS. ← Page 8 of 12 →

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

House Of Commons.

A division took place on the first resolution—214 for it—against it 15 . The other resolutions were then carried . Wednesday , 6 . Mr . Pitt presented a Message from the Sovereign , intimating his intention to go in solemn procession to St . Paul's Cathedral oh Tuesday the 19 th inst . & e . the same as presented to the other House .

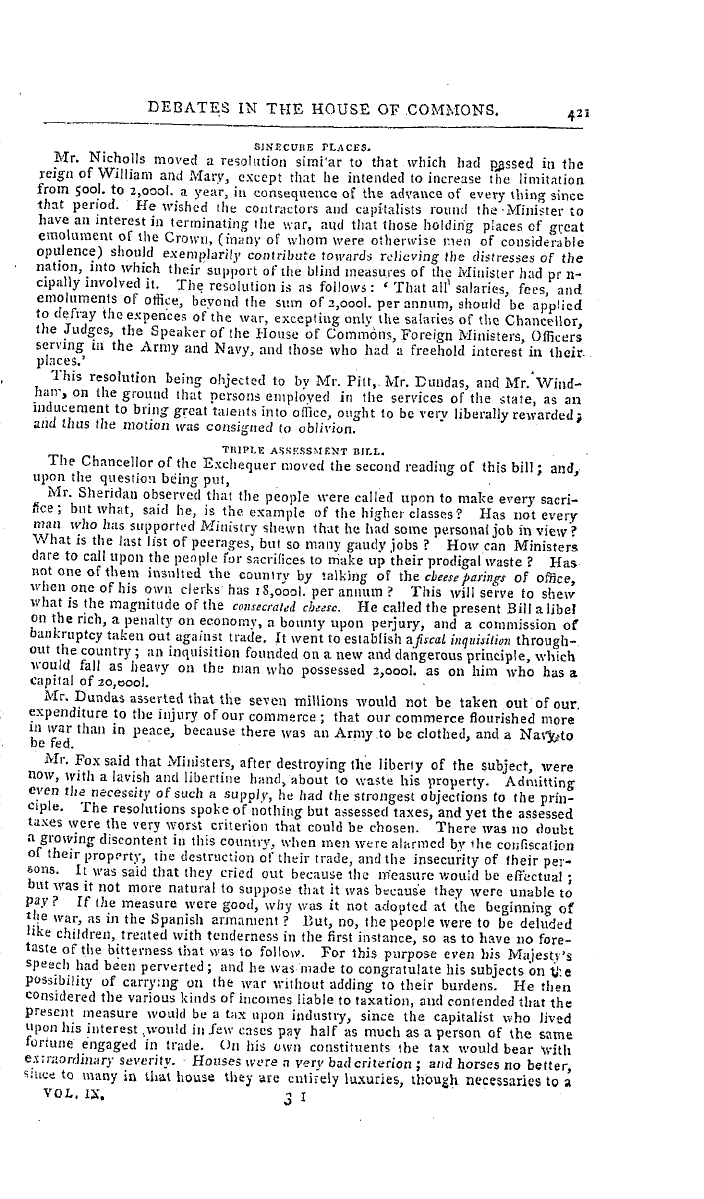

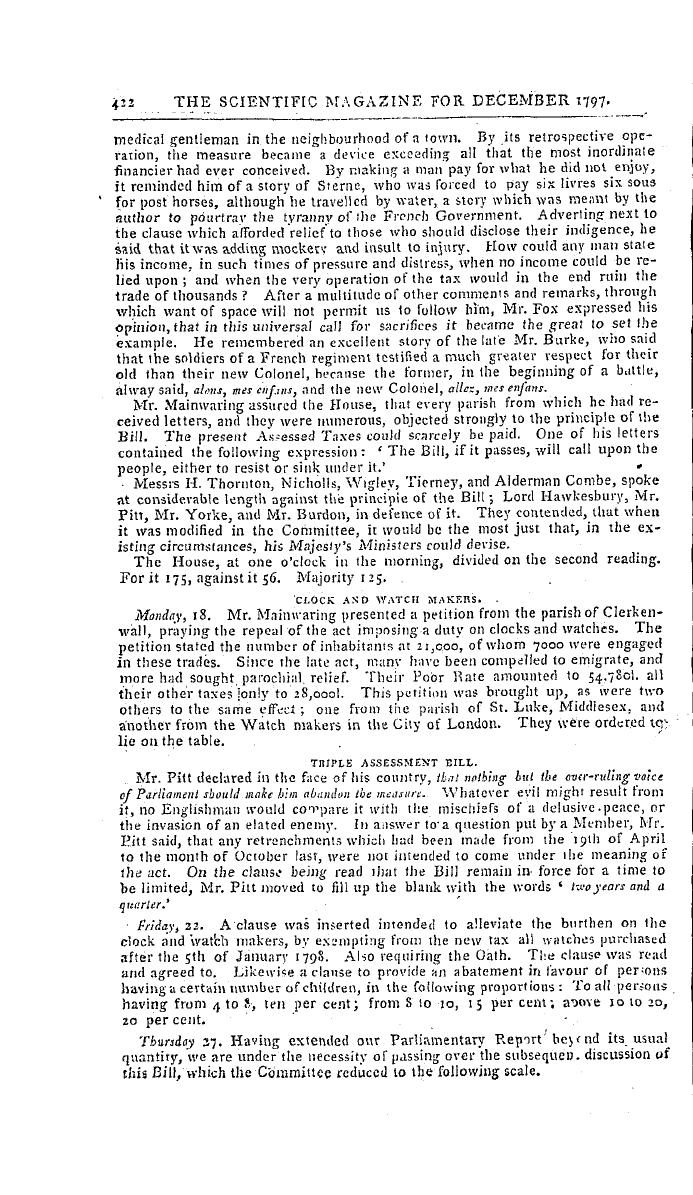

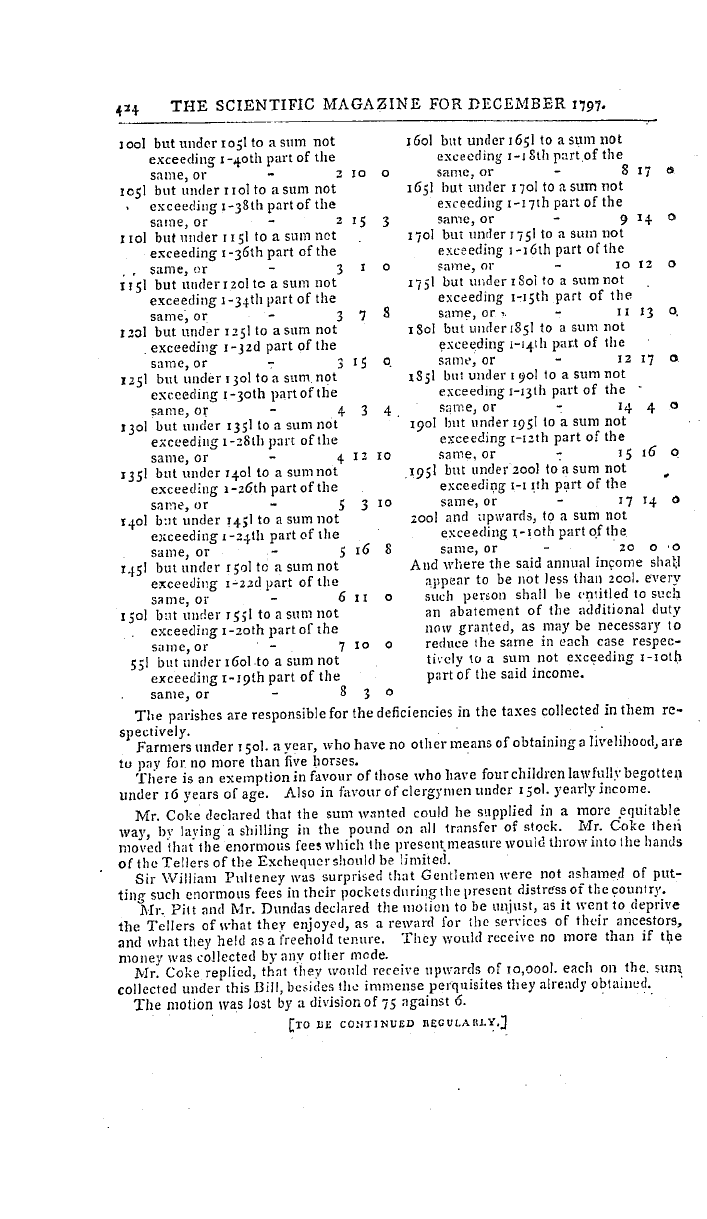

TIUPLE ASSESSMENT . Thursday , 7 . The Chancellor ofthe Exchequer brought in the Bill for granting to his Majesty certain duties on the taxes raised by assessment , which was read « a first time . On the motion that it be read a second time , Mr . Wilberforce Bird opposed the . measure as ruinous to the class of manufacturers and tradesmen , to whom no relief in fact was afforded , since they could hot state their income as small without ruin to their credit . He had conversed with many manufacturers , who were all of opinion that the middle classes in commercial

towns , who were endeavouring to rise by thrift and industry , would be ruined by the tax in agitation . That of the last session on watches had ruined the watch trade in the city he represented . The masters were in want , and the workmen starving . Fie would vote the necessary supplies , but not by such means . He wished that gentlemen of great landed property would stand up , and offer their land for taxation . Mr . Burdon approved the Bill . He wished to see landed property so considered as to give greater effect to the measure . The property of great landed proprietors

might be known by the poor rates , and brought within the view ofthe Bill ; nor was it so indelicate to call upon a great landholder to declare his income as upon a person in trade ; nor so great a hardship to take a tenth part of it . Alderman Lushington concurred with Mr . Burdon . He observed , that the Minister , in opening his plan , had expressed great tenderness towards the lower classes ; buthe had not framed his Bill accordingly . It was owing to the extensive distribution of property , that revolutionary principles had been rejected in this country : men not beinsr attached to a constitution in the abstract but to the

commons they , enjoy under it . He cared little for the complaints of those who had from one to ten thousand a year—but not of those who earned from 150 to 200 I . He should therefore propose that those who didnot pay loi . to the assessed taxes should pay nothing ; and that those who paid that sum or more should contribute one half more than it was intended to make them contribute . By these means six and a half millions might be raised . He thought highly of Ministers , but he cautioned them against breaking down the middle classes . Mi ? Pitt surprised at what had fallen from the two last speakersand boldly

was , challenged a comparison of his financial measures with those of any former period . The proposal ofthe latter , he said , went to fritter away and counteract the tax . He then went at some length into a vindication of the Bill , and contended that the seven additional millions to be raised in one year would not be altogether taken from the active capita ] of the country . Sir G . Shuckburg Evelyn said there was an obvious inequality 111 rating a particular class of pesons , who paid from 90 I . to 400 I . Mr . Ryder saw no

ground for this opinion . Mr . Curwen believed that it was impossible to carry the measure into execution because many ofthe classes upon whom it would be imposed were unable to pay ' their present rates , in one parish alone , ( St . Andrew ' s below the Bar ) of 181 persons who had been summoned for-non-payment , nearly one-third were unable to pay . In Marybone parish , 700 were summoned in one week , of whom a great number were also incapable of paying their arrears . And this wasthe case , more or less , all over ( he kingdom . „ ,,,., Mr Ellison thought that i 9-20 ths of this country looked up to Mr . Pitt for salvation . He was of opinion , however , that the rich were not sufficiently

taxed . '' Friday , 8 . Mr . Pitt moved a Bill for borrowing , on Exchequer Bills , of the Bank three millions , to be paid by instalments in May and June next , unless a change in the situation of the country made it necessary to be raised in another way .

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

House Of Commons.

A division took place on the first resolution—214 for it—against it 15 . The other resolutions were then carried . Wednesday , 6 . Mr . Pitt presented a Message from the Sovereign , intimating his intention to go in solemn procession to St . Paul's Cathedral oh Tuesday the 19 th inst . & e . the same as presented to the other House .

TIUPLE ASSESSMENT . Thursday , 7 . The Chancellor ofthe Exchequer brought in the Bill for granting to his Majesty certain duties on the taxes raised by assessment , which was read « a first time . On the motion that it be read a second time , Mr . Wilberforce Bird opposed the . measure as ruinous to the class of manufacturers and tradesmen , to whom no relief in fact was afforded , since they could hot state their income as small without ruin to their credit . He had conversed with many manufacturers , who were all of opinion that the middle classes in commercial

towns , who were endeavouring to rise by thrift and industry , would be ruined by the tax in agitation . That of the last session on watches had ruined the watch trade in the city he represented . The masters were in want , and the workmen starving . Fie would vote the necessary supplies , but not by such means . He wished that gentlemen of great landed property would stand up , and offer their land for taxation . Mr . Burdon approved the Bill . He wished to see landed property so considered as to give greater effect to the measure . The property of great landed proprietors

might be known by the poor rates , and brought within the view ofthe Bill ; nor was it so indelicate to call upon a great landholder to declare his income as upon a person in trade ; nor so great a hardship to take a tenth part of it . Alderman Lushington concurred with Mr . Burdon . He observed , that the Minister , in opening his plan , had expressed great tenderness towards the lower classes ; buthe had not framed his Bill accordingly . It was owing to the extensive distribution of property , that revolutionary principles had been rejected in this country : men not beinsr attached to a constitution in the abstract but to the

commons they , enjoy under it . He cared little for the complaints of those who had from one to ten thousand a year—but not of those who earned from 150 to 200 I . He should therefore propose that those who didnot pay loi . to the assessed taxes should pay nothing ; and that those who paid that sum or more should contribute one half more than it was intended to make them contribute . By these means six and a half millions might be raised . He thought highly of Ministers , but he cautioned them against breaking down the middle classes . Mi ? Pitt surprised at what had fallen from the two last speakersand boldly

was , challenged a comparison of his financial measures with those of any former period . The proposal ofthe latter , he said , went to fritter away and counteract the tax . He then went at some length into a vindication of the Bill , and contended that the seven additional millions to be raised in one year would not be altogether taken from the active capita ] of the country . Sir G . Shuckburg Evelyn said there was an obvious inequality 111 rating a particular class of pesons , who paid from 90 I . to 400 I . Mr . Ryder saw no

ground for this opinion . Mr . Curwen believed that it was impossible to carry the measure into execution because many ofthe classes upon whom it would be imposed were unable to pay ' their present rates , in one parish alone , ( St . Andrew ' s below the Bar ) of 181 persons who had been summoned for-non-payment , nearly one-third were unable to pay . In Marybone parish , 700 were summoned in one week , of whom a great number were also incapable of paying their arrears . And this wasthe case , more or less , all over ( he kingdom . „ ,,,., Mr Ellison thought that i 9-20 ths of this country looked up to Mr . Pitt for salvation . He was of opinion , however , that the rich were not sufficiently

taxed . '' Friday , 8 . Mr . Pitt moved a Bill for borrowing , on Exchequer Bills , of the Bank three millions , to be paid by instalments in May and June next , unless a change in the situation of the country made it necessary to be raised in another way .